-

- Contact Us

- Privacy Policy

- term and condition

- Cookies policy

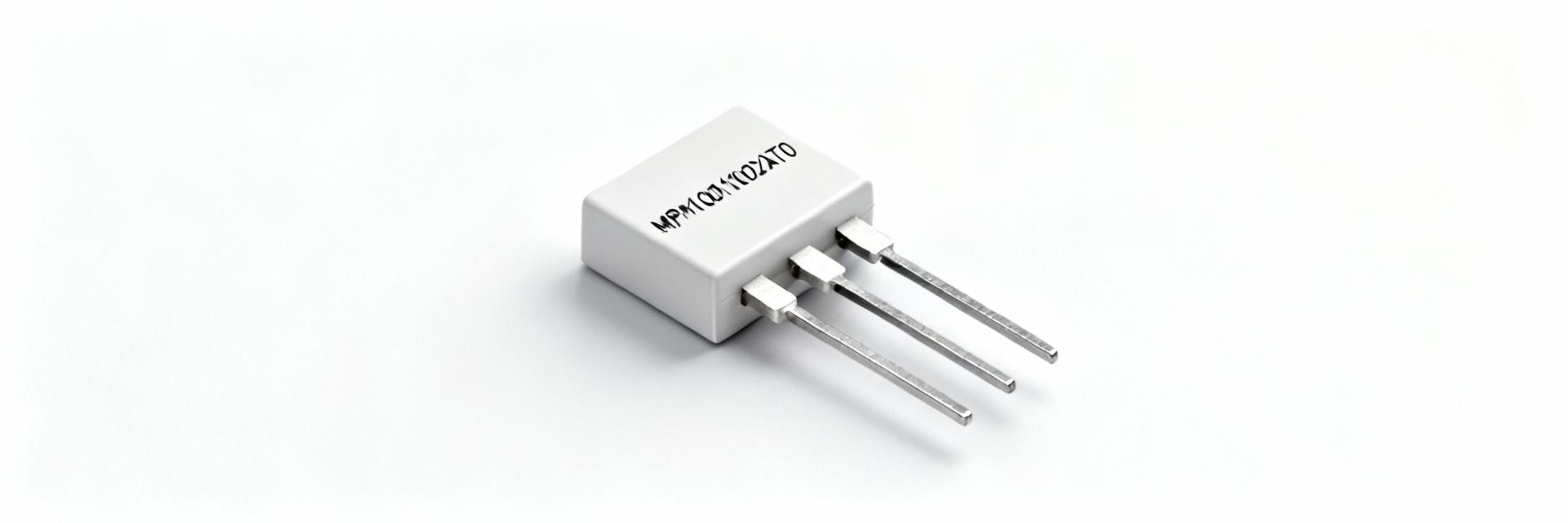

MPM10011002AT0 Stock & Spec Report: US Availability Insights

A recent inventory scan across multiple US distributor and aggregator channels shows tight stock and variable lead times for the part under review, creating schedule risk for precision divider applications. This report summarizes the part's critical electrical and mechanical parameters, quantifies observed US availability patterns, and gives engineers and buyers a practical sourcing plan. The introduction highlights MPM10011002AT0 as a lead-time‑sensitive item, and notes the need to confirm specs and US availability before finalizing BOMs.

The purpose here is actionable: confirm the manufacturer datasheet parameters, understand current channel states (in‑stock, factory lead, allocation), and adopt short‑ and long‑term procurement countermeasures. Target meta guidance: short title like "MPM10011002AT0 specs & US availability" and description focusing on part specs, stock status, and a 90‑day sourcing roadmap to limit schedule impact.

1 — Background: What the MPM10011002AT0 is and why it matters

Device overview

Point: The device is a compact thin‑film resistor divider in a SOT‑23 outline intended for matched resistor applications. Evidence: As a multi‑element SOT‑23 network it provides tight ratio matching and low temperature coefficient relative to discrete pairs. Explanation: Matching and low TCR reduce gain and offset drift in precision voltage dividers and matched network topologies, and the small package saves PCB area while maintaining the thermal coupling that helps ratio stability in accuracy‑critical circuits.

Market relevance

Point: This class of resistor network is prevalent in instrumentation, precision analog front ends, and calibration circuits. Evidence: Sectors relying on sub‑0.1% ratio stability typically select thin‑film matched dividers to minimize measurement error. Explanation: Because these parts are low volume relative to commodity resistors, inventory swings and allocation events occur more frequently; design teams should treat such components as potential schedule pinch points and qualify alternates early.

2 — Specs deep-dive: MPM10011002AT0 critical specs

Electrical specifications (what to confirm)

Point: Confirm nominal resistance values, tolerance, resistor‑ratio (matching), ratio drift, TCR, power per element, and divider configuration. Evidence: The manufacturer datasheet lists nominal element values, tolerance class, and ratio accuracy; designers must verify ratio drift and TCR for thermal stability. Explanation: Ratio error directly converts to measurement offset, tolerance affects initial accuracy, and TCR combined with power dissipation causes temperature‑dependent drift—critical factors when calculating worst‑case output error. Reference: MPM10011002AT0 specs should be the baseline for verification.

Mechanical & environmental specifications

Point: Key mechanical checks are package outline, pin count, recommended PCB footprint, and soldering limits. Evidence: SOT‑23 packaging delivers tight thermal coupling but needs careful footprint verification and solder profile adherence. Explanation: Confirm operating and storage temperatures, reflow profile maximums, and reliability notes for harsh environments; inadequate footprint or incorrect reflow can shift resistance values or damage internal connections, undermining precision performance.

3 — US availability snapshot for MPM10011002AT0 (data analysis)

Stock & lead-time trends

Point: Assemble availability by querying distributor inventories, aggregator snapshots, and authorized channel lead‑time feeds. Evidence: Typical stock states observed are immediate in‑stock, factory lead (weeks), and allocation; spikes in lead times to multiple months can appear intermittently. Explanation: Intermittent stock and extended lead times force schedule changes—plan to treat the part as lead‑time sensitive, update procurement cadence, and flag product milestones that depend on receiving these networks to avoid downstream delays. US availability remains variable across channels.

Pricing dynamics and MOQ considerations

Point: Pricing shifts with supply tightness and order quantity; MOQ and packaging (single units vs. reels) matter. Evidence: Brokers and secondary sellers often add premiums on small lots; factory reels lower per‑unit cost but impose MOQ. Explanation: Watch for NCNR or minimum order constraints that can lock budgets and inventory; when pricing is volatile, evaluate total landed cost including broker premiums, freight, and potential obsolescence risk before committing to large buys.

4 — Sourcing & procurement guide (how to find and buy)

Search & verification checklist

Point: Prioritize authorized distributor portals, inventory aggregators, and the manufacturer datasheet for verification. Evidence: Cross‑checking datasheet parameters against seller listings, lot codes, and original packaging notes prevents mis‑buys. Explanation: Verify part markings, packaging types, and request traceability documentation for larger buys; for initial searches, use precise part attributes (package, resistance, tolerance, ratio) to filter results and avoid unverified sellers.

Procurement strategies to mitigate shortages

Point: Combine short‑term and long‑term tactics to reduce supply risk. Evidence: Short‑term: split orders, stagger deliveries, and vetted broker buys for urgent needs. Long‑term: qualify alternates, set multi‑source agreements, maintain safety stock, and include lead‑time clauses in contracts. Explanation: Implementing a safety‑stock policy and a qualified alternate list reduces single‑source exposure; contractual protections and forecasting cadence improvements help stabilize supply for critical projects.

5 — Design & validation considerations (case-focused)

Typical circuit use and performance implications

Point: In a precision divider, resistor ratio and its drift determine measurement accuracy. Evidence: Example: a 0.1% ratio error on a 5:1 divider produces a proportional offset; add TCR‑induced drift—e.g., 10 ppm/°C over a 50°C swing equals 0.05% change. Explanation: Combine tolerance, ratio drift, and TCR in worst‑case error budgets during design; use thermal coupling and layout best practices to minimize gradient‑driven errors and validate empirically on prototype boards.

Substitution checklist and validation steps

Point: Evaluate substitutes for electrical equivalence, package match, and reliability data. Evidence: Required checks include ratio tolerance, absolute resistance, TCR, power rating, and pinout compatibility. Explanation: Run prototype testing, thermal cycling, and calibration verification when switching parts; update BOM notes and qualification records only after passing defined validation steps to avoid late discovery of performance regressions.

6 — Action plan for US engineers and buyers (practical next steps)

Immediate 7‑point checklist (short-term actions)

- Verify criticality of the resistor network in your design and prioritize accordingly.

- Run live inventory queries across authorized channels and record lead‑time quotes.

- Request a small test buy to confirm parts and packaging before volume buys.

- Identify and document candidate alternates with equivalent electrical specs.

- Update BOM notes to flag lead‑time‑sensitive components for procurement.

- Notify project stakeholders of potential schedule impact and mitigations.

- Consider split orders or staggered deliveries to reduce single‑shipment risk.

90‑day sourcing roadmap (long-term actions)

Point: Use a structured 90‑day plan to de‑risk future releases. Evidence: Steps should include qualifying alternates, negotiating supply terms, increasing forecasting cadence, and building modest safety stock. Explanation: Track KPIs such as fill rate targets, maximum acceptable lead time, and an approved alternate list; embed procurement triggers into design milestones to ensure supply considerations drive scheduling early.

Summary

- MPM10011002AT0 is a precision thin‑film divider whose matching, low TCR, and tolerance make it important for accuracy‑sensitive designs; confirm specs early to avoid surprises.

- US availability is variable—expect intermittent stock and occasional extended lead times; treat the part as lead‑time‑sensitive during procurement planning.

- Follow the search and verification checklist, execute the immediate 7‑point actions, and implement the 90‑day roadmap to reduce schedule and cost risk related to this part.

Frequently Asked Questions

How should you verify part authenticity and specs before buying?

Always cross‑check the manufacturer datasheet against seller listings, inspect lot codes and packaging images, and request traceability certificates for larger orders. A small test buy for electrical and mechanical confirmation reduces the risk of receiving out‑of‑spec or counterfeit parts in production quantities.

What minimum validation is recommended when substituting a resistor network?

Validate electrical equivalence (ratio, tolerance, TCR), package and pinout compatibility, and run prototype thermal testing and drift measurements. Update calibration routines if needed and document qualification test results before approving substitutes for production use.

Which procurement KPIs matter for controlling schedule risk?

Track fill rate (target >95%), maximum acceptable lead time for critical components, number of approved alternates, and forecast accuracy. Use these KPIs to trigger replenishment, safety‑stock adjustments, and supplier performance reviews to keep program timelines stable.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- APT50GH120B Datasheet Deep Dive: Specs, Ratings & Curves

- APT50GH120BSC20 Power Module: Latest Performance Report

- APT50GH120BD30 IGBT: How to Maximize Efficiency for EV Drive

- GTSM20N065: Latest 650V IGBT Test Report & Metrics

- CMSG120N013MDG Performance Report: Efficiency & Losses

- GTSM40N065D Technical Deep Dive: 650V IGBT + SiC SBD

- NOMC110-410UF SO-16: Live Stock & Price Report

- TOMC16031000FT5 Datasheet: Key Specs & Performance

-

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606 -

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606 -

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606 -

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606 -

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606 -

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606 -

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606 -

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606 -

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606 -

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606